Funding sources

Bunzl’s core funding comprises bank facilities, US Private Placement Notes and Public Bonds.

Credit ratings

The Group’s debt is rated by Standard & Poor’s as BBB+ (since November 2017) with a stable outlook.

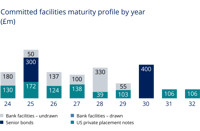

Maturity profile

Outstanding Public Bonds

| Issuer | Currency | Amount | Coupon | Issue date | Maturity |

| Bunzl Finance plc | GBP | 300m | 2.25% | 11/12/2017 | 11/06/2025 |

| Bunzl Finance plc | GBP | 400m | 1.50% | 30/10/2020 | 30/10/2030 |

The Public Market core issuance programme, which was originally launched in 2020, is a £1.5billion Euro Medium Term Note programme. This is listed on the International Securities Market of the London Stock Exchange and is guaranteed by Bunzl plc.